New MedTech Funding: A Light at the End of the Tunnel?

The first half of 2024 paints a hopeful picture for MedTech startups. Three recent reports published by J.P. Morgan, Rock Health, and Galen Growth present slightly different views of the market, but all show encouraging funding growth trends.

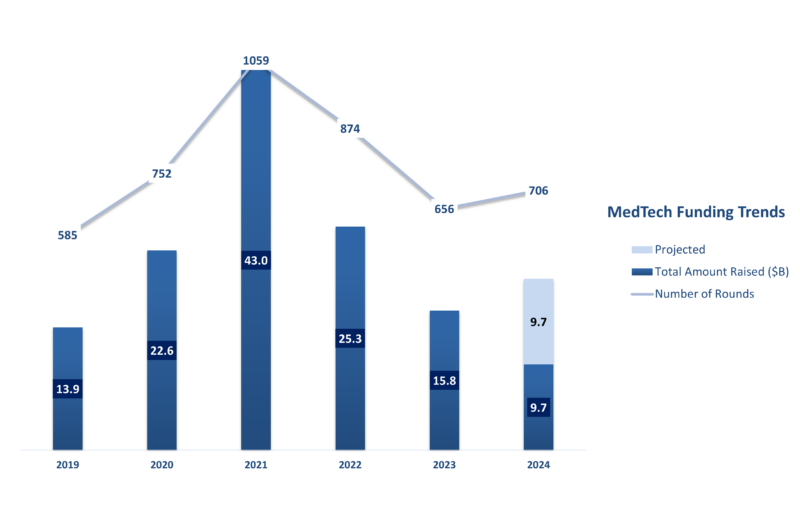

According to the J.P. Morgan report, US MedTech startups raised $9.7 billion in venture funding across 353 rounds in the first six months of 2024. This upward trend is promising. If this momentum continues, we can expect over 20 percent growth in total MedTech funding for the year.

Data Source: J.P. Morgan

Early Stage Surge

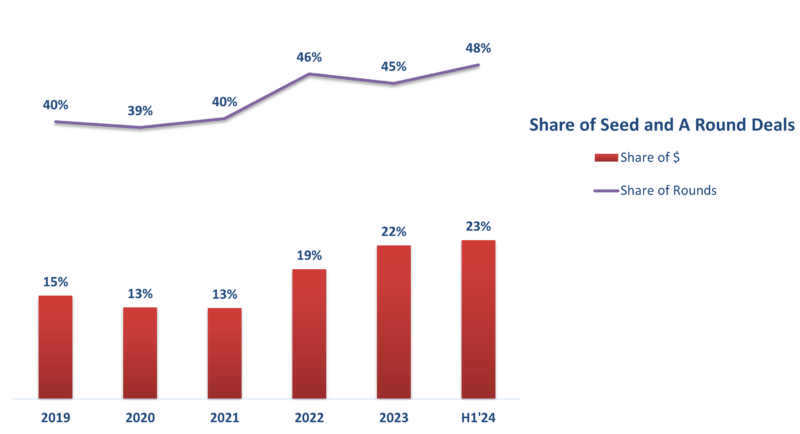

In contrast to previous years, early-stage funding rounds stood out as a bright spot in the MedTech funding landscape. With $2.4 billion in 188 rounds completed in H1 2024, seed and A round investments are on track to beat the previous two years and come close to the pandemic-fueled record of 2021.

This surge in early-stage funding indicates that investors are increasingly prioritizing innovation and showing a greater willingness to embrace risk. It also helps that new startups don’t have the same inflated valuations that some previously-funded companies carry from the pandemic bubble years.

Data Source: J.P. Morgan

Decline in Unlabeled Rounds

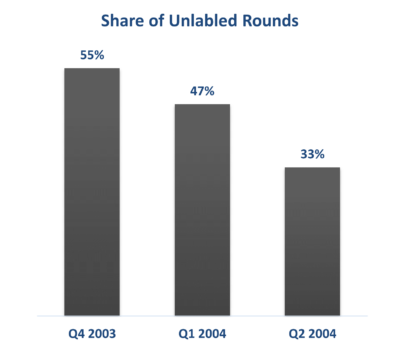

Unlabeled rounds—investments that do not clearly specify the stage of funding—often increase during transitional periods in market conditions, when startups require capital but haven't yet achieved the necessary benchmarks for their next funding round.

While the number of these unlabeled rounds is still significant, it is clearly declining from its peak. This trend suggests a return to more traditional and transparent funding patterns, where both investors and startups are aligning expectations more closely. Investors are becoming more discerning, focusing on startups with clear value propositions and strategic objectives.

Data Source: Rock Health

AI Is the Locomotive

AI continues to be a driving force in MedTech funding, attracting significant investor interest in the first half of 2024. According to the Galen Growth report, AI-focused ventures accounted for 57% of total digital health funding globally, underscoring the technology’s pivotal role in shaping the future of healthcare.

But Don’t Get Blinded by the Light: How Do You Make Your Funding Dollars Go the Extra Mile?

Despite the resurgence in MedTech funding, startups still face a highly demanding investment environment. They must make the best use of early rounds funds to achieve critical milestones, gain investor confidence, and secure subsequent financing.

Simplify for Success

Innovators often fall into the trap of overloading their initial product versions with an abundance of features. However, simplicity can often be the key to unlocking a device's true potential. By focusing on novel features and critical functionality, eliminating superfluous features, and relegating extensive data analysis to external systems, we can create a device that excels in its intended purpose while optimizing development effort.

Simplified designs are not only easier to develop but can also enhance reliability, streamline regulatory approval, improve energy efficiency, and reduce costs:

- Enhanced reliability: Fewer components and simpler functions reduce the likelihood of malfunctions, ensuring a more consistent performance.

- Streamlined approvals: By minimizing non-critical features, startups can reduce extensive testing and documentation requirements and minimize delays in regulatory approvals.

- Energy efficiency: Simpler designs can help minimize power consumption—reducing the frequency of surgical replacements or recharging procedures for patients.

- Cost-effectiveness: Simplification often leads to lower material and assembly costs, making the device more affordable.

Read more: The Power of Simplicity in Implantable Medical Devices

Manage Development Priorities

Prioritizing critical milestones can help startups manage their cash flow and maintain investor confidence. This involves defining clear, achievable goals for each stage of product development, from proof of concept (POC) to fully functional versions ready for clinical trials and market entry.

- Proof of Concept (POC): The primary goal at this stage is to demonstrate technological feasibility without the need for full functionality or regulatory approval.

- Version One (V1): This version must be fully functional and ready for clinical trials, meeting strict compliance and documentation requirements while avoiding non-essential functions.

- Version Two (V2): A fully commercialized version incorporating user feedback and refinements, V2 can be developed in parallel to V1.

Leverage Proven Technologies

By focusing innovation on unique aspects of the device and leveraging transferable technologies, startups can significantly cut down development time and costs. Utilizing proven technologies for non-unique aspects of the device can also reduce development risks, enhance reliability, and shorten approval timelines.

Read more: Leverage Existing Know-how to Accelerate Device Commercialization

Apply Efficient Data Strategies

With AI representing a key driver of investor interest, formulating a clear data acquisition strategy that accounts for clinical and operational tradeoffs becomes critical for any device venture.

Implantable devices operating in an ultra-low power setting require a careful balance between data collection parameters and power consumption. While more detailed data may provide deeper insights, it comes with the added cost of increased storage space, extended wireless transmission times, and more powerful on-board processing requirements. Greater power consumption means more frequent battery charging or replacements, resulting in added cost, risk, and patient discomfort.

Read more: Balancing Signal Data vs. Power Consumption in Your Device

Establish Predictable Product Development Costs

Fixed-cost pricing for predefined milestones eliminates concerns over unexpected expenses, providing startups with better control over their cash outlay. Milestone-based pricing models create a symbiotic relationship between device innovators and their development partners, fostering transparency, trust, and mutual success. This approach aligns the incentives of both parties, ensuring that projects stay on track and within budget.

Read more: Celebrating A Decade of Milestone-Based Pricing Projects

Seize the Moment, Make it Last

The recent rise in MedTech investment is a moment to celebrate and capitalize on the opportunities it presents. At the same time, it remains to be seen whether this surge marks the start of a lasting trend or merely a temporary uptick.

Startups should seize the moment by leveraging new funding to accelerate innovation, while keeping an eye on the prize and optimizing product development strategies to make whatever funds they can raise go as far as they can.

MOST READ POSTS

Insights from a decade of milestone-based projects

Transforming biosignals into clinical insights

Why investors say No to medical device startups