MedTech investment data coming out of 2025 sends a mixed signal.

Despite the backdrop of growing regulatory turmoil and economic uncertainty, venture funding remained stable. IPO activity continued a slow but steady recovery, showing the market that capital is still available for the right companies.

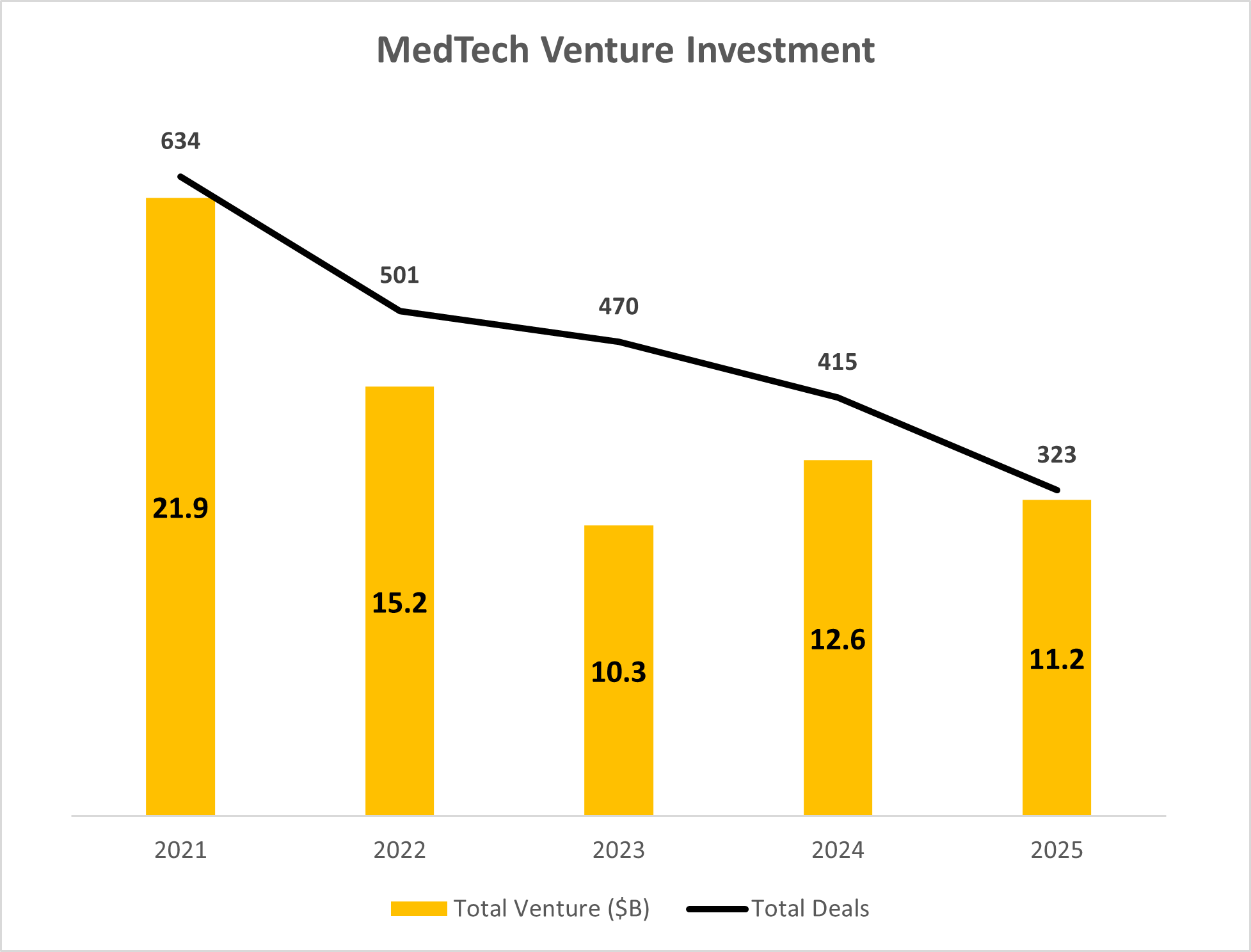

According to J.P. Morgan’s MedTech Report, 2025 venture funding reached $11.3B. Overall dollar commitment was inline with the previous two years, suggesting continued investor engagement.

While the overall level of investment held steady, the number of companies that secured ventured investment dollars continued to drop at a fast pace, reaching a new 5-year low of only 323 rounds in 2025.

What the data show is that the market didn’t pull back—it narrowed.

Source: J.P. Morgan 2025 MedTech Report

Early rounds land fewer bets, higher commitment

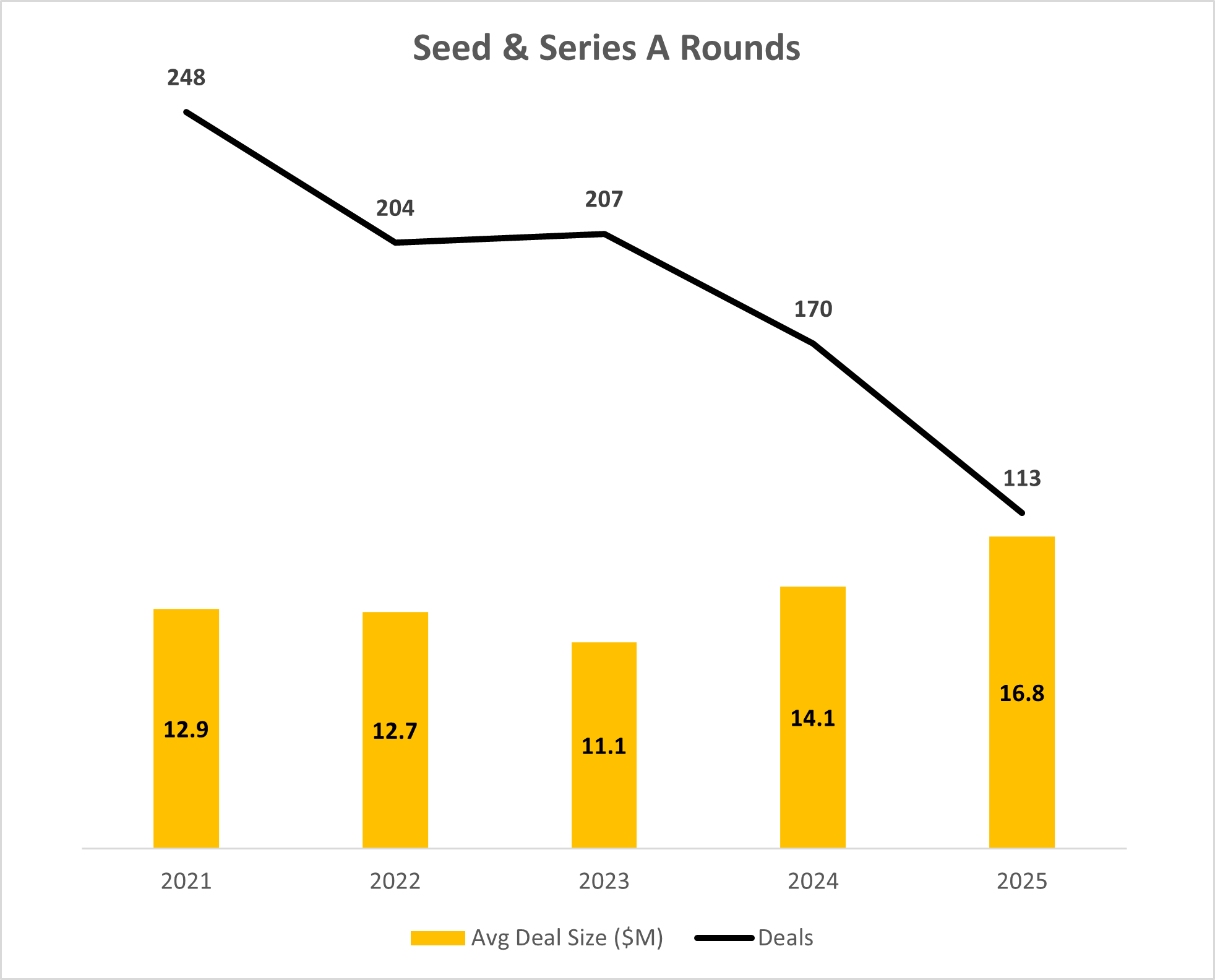

Nowhere is the narrowing of the market more evident than in early investment rounds.

In 2025, Seed and Series A companies raised $1.9B across 113 rounds. Investment dollars in these early rounds were down twenty percent from 2024 levels, and the lowest registered in the past five years.

The bigger story emerges when you look at deal count, which dropped significantly compared to prior years. This is a significant acceleration of a trend we have been observing over the past five years.

At the same time, average early-stage deal sizes increased, reaching their highest levels of the past several years. Investors are making fewer bets, but committing more capital when they do.

Taken together, these two trends show that early stage investment is no longer about proving an idea is interesting. It’s about proving it’s buildable, regulatable, and worth scaling.

Source: J.P. Morgan 2025 MedTech Report

What investors are screening for earlier than before

By 2026, early-stage diligence looks less like a pitch review and more like a risk audit.

Here’s what many investors are effectively screening for—often before they say yes to a first meeting.

Regulatory credibility

- A realistic pathway and rationale

- Early alignment between indications, claims, and evidence

- No major unanswered regulatory questions parked for “later”

Technical readiness

- System architecture that can evolve without major rework

- Clear tradeoffs across power, size, performance, and cost

- Evidence the design can survive verification and validation

Manufacturability awareness

- Prototypes that can transition to pilot and low-volume builds

- Early understanding of NRE, tooling, and supply chain risk

- Clear visibility into scalability beyond early builds

Capital efficiency

- A plan that preserves runway while increasing certainty

- Spend focused on proof points that increase valuation

- Milestones tied to risk reduction, not calendar time

Data quality

- Data that is structured, traceable, and usable

- Early signals that future clinical, AI, or commercial claims will hold up

None of these are new concepts. What’s changed is how early investors expect these risks to be already understood and planned for at the Seed or Series A stage.

The takeaway for founders heading into 2026

The shift in early-stage investor expectations does not mean startups need to do more upfront. In fact, misreading this data often leads teams in the wrong direction.

1. Don’t confuse higher expectations with more functionality

A common reaction to tighter early-stage funding is to assume that investors want more: more features, more use cases, more integrations, more endpoints.

That’s rarely what the data supports.

What investors are really looking for is focus.

Strong early-stage programs are increasingly defined by a clear, narrow objective—and disciplined execution against it. Teams that try to broaden scope too early often introduce unnecessary technical, regulatory, and manufacturing risk, exactly when the market is least forgiving.

Less functionality—chosen intentionally and aligned to the immediate goal—often produces greater investor confidence. In practice, this means:

- Defining a single, defensible use case

- Designing only the functionality required to prove that use case

- Resisting the temptation to future-proof the product with features that don’t serve the next inflection point

2. Manage the program to the goal, not the roadmap

Early-stage plans frequently fail because they optimize for activity instead of outcomes and risk reduction.

Successful teams ensure that every engineering, regulatory, and clinical decision is mapped directly to the next value-creating milestone: a clearer regulatory path, stronger data, a manufacturable design, or a lower-risk clinical step.

Programs that manage tightly to a defined goal:

- Spend less capital to reach meaningful proof points

- Avoid rework driven by late-stage surprises

- Create cleaner narratives for the next raise

3. Treat data a critical asset from day one

Data is no longer just something you collect to support a future claim. It’s now a key criterion for investors to assess whether the system and the strategy are sound.

Teams that treat data as an asset rather than a byproduct of development are better positioned to support regulatory scrutiny and future AI or analytics initiatives without rework.

A strong early data strategy includes:

- Designing data capture with regulatory, clinical, and commercial use in mind

- Ensuring traceability from raw signals to claims

- Avoiding one-off datasets that can’t be reused or extended

4. Build with manufacturing reality in mind—early

A working prototype is not the finish line. For many teams, it’s where the hardest problems begin—especially when manufacturing constraints surface late and force expensive redesigns.

Early-stage investors are increasingly sensitive to this risk.

Programs that integrate manufacturing considerations early tend to move faster and burn less capital over time. That includes:

- Designing architecture and requirements with manufacturability in mind

- Validating designs through low-volume builds for V&V, preclinical, or first-in-human use

- Learning from real assembly and test processes, not just CAD models

Why milestone-based development matters more now

In today’s market, milestones are the currency of confidence. As expectations move earlier, milestones are no longer just a way to organize work; they are how early-stage teams demonstrate discipline, focus, and credibility in a more selective market.

A meaningful milestone isn’t a date on a timeline or a box to check on a roadmap. It is a moment where uncertainty is replaced with evidence and promises are replaced with progress.

At the right milestones:

- Technical uncertainty drops because core architecture and performance tradeoffs are validated

- Regulatory visibility improves because claims, indications, and evidence are aligned early

- Manufacturability is designed in rather than deferred, reducing downstream risk

- Capital efficiency improves because budgets are realistically scoped to completion

- Investor risk perception changes because progress is tangible and predictable

Practical questions for your team

If you’re planning a Seed, Series A, or extension round, here are some questions to ask yourself and your team:

- What specific risks will we retire in the next 6–12 months and why do those risks matter most right now?

- What concrete evidence will prove that each risk is meaningfully lower (data, test results, regulatory feedback, manufacturing learnings)?

- Which investor objections does that evidence directly remove, and which new questions will it inevitably raise?

Teams that can answer these questions crisply tend to control the fundraising narrative. They can explain not just what they’re building, but why each step matters, what uncertainty it resolves, and how it positions the company for the next round.

Answer those questions clearly—and the 2026 funding environment becomes more navigable.

Because the bar didn’t just move higher. It moved earlier.

Additional resources

- The Startup Guidebook: Navigating Medical Device Funding Cycles

- How we make fixed-cost pricing work

- Contact us to see how milestone-based pricing can work for your project.

MOST READ POSTS

Insights from a decade of milestone-based projects

Transforming biosignals into clinical insights

Why investors say No to medical device startups