A look back at the investment trends for medical device companies in 2024 presents a picture of renewed vigor at the bookends of the path to commercialization, with challenging times for companies in the middle of the road.

While early-stage funding and merger and acquisition (M&A) activity showed considerable gains compared to the previous year, late-stage investments grew at a much slower rate and often with depressed valuations.

To successfully cross the late-stage funding chasm, startups must make every dollar count by focusing on meeting investor expectations and hitting key product milestones with their limited early-stage capital. Prioritizing critical development goals and adopting milestone-based pricing can help maximize resources, maintain investor confidence, and increase valuations for late-stage rounds.

Exit activity: A resurgence in M&A, and are IPOs back?

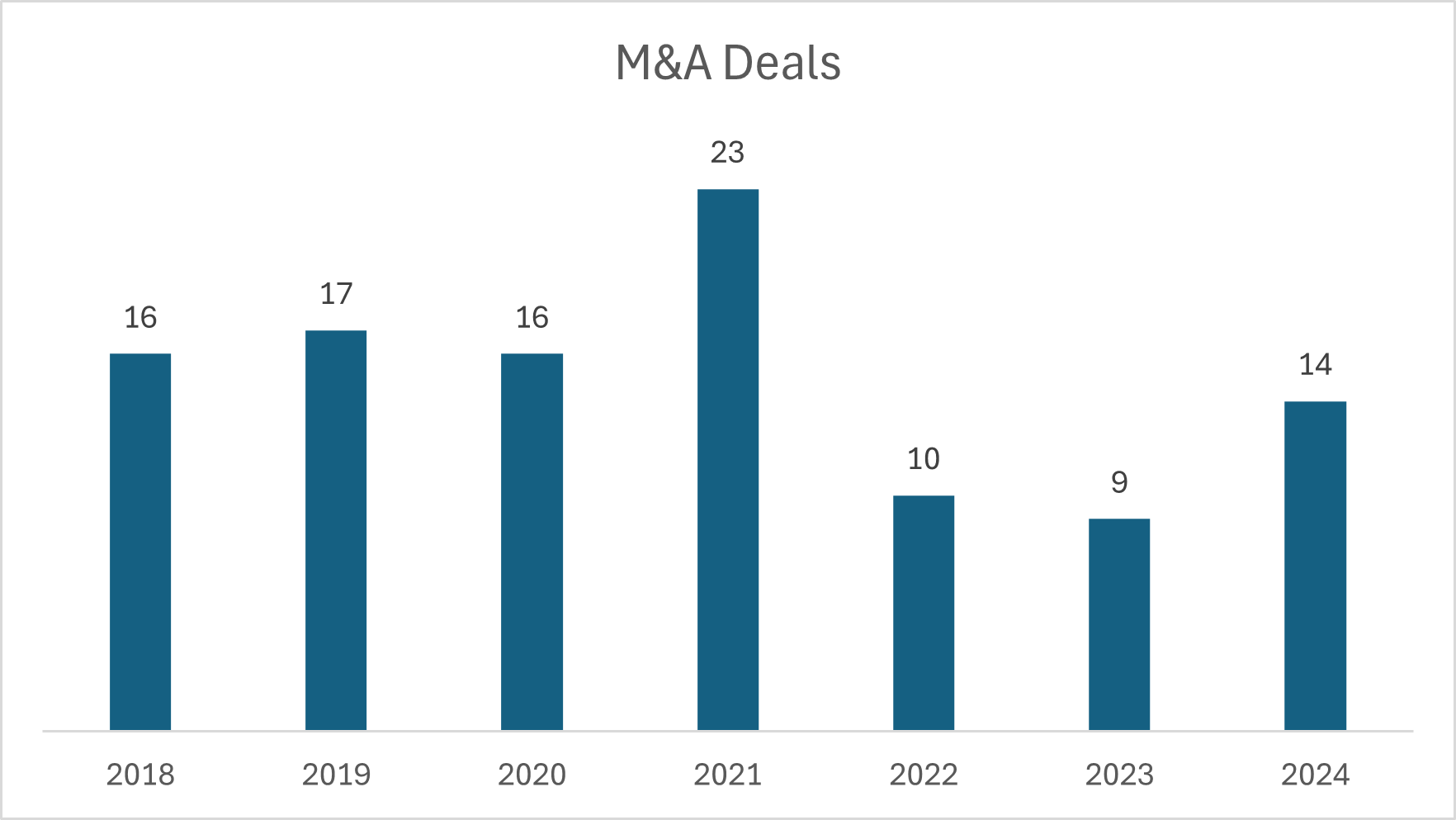

Following a slow M&A activity in the first half of the year, medical device companies saw a strong rebound in Q3, ending 2024 with 14 major acquisitions, a 56% year-over-year (YoY) increase.

The surge was led by 5 cardiovascular deals with a median upfront value of $500M and 2 orthopedic deals with a median upfront value of $415M. While the median valuation for M&A deals was down from its high of 2023, it showed an upward trend compared to the previous 5 years.

In Q4 we saw the first medical device IPO of the year, when Ceribell raised $180 million in proceeds. The IPO reflected a pre-money step-up from its last private round, and its stock has since nearly doubled in post-money value. Whether this was an exception or a signal of renewed IPO interest remains to be seen.

Source: HSBC 2024 Annual Venture Healthcare Report

Venture financing grows with broad investor interest

In 2024, total medical device venture investment reached $7.5 billion across 421 deals, a 15% increase from the $6.5 billion raised in 2023 across 430 deals. Despite this overall growth, the market showed clear signs of concentration of capital in established, commercial-ready players, with the top 10% of deals representing 60% of all investment dollars.

Late-stage medical device deals attracted the most varied funding mix in over a decade, signaling renewed interest from strategic investors in the medical device sector, including traditional venture capital, private equity, growth investors, and crossover funds. Corporates from pharma, diagnostics, and medtech also re-entered the investment space, helping fund both large and small transactions.

Early-stage rebounds, late-stage gets greater scrutiny

Early-stage investment in medical devices showed considerable growth in 2024, with total first-financing investment reaching $971 million across 106 deals, a 34% increase from $726 million across 105 deals in 2023.

Late-stage rounds (Series B or later) grew at a much slower rate in 2024, with a smaller number of deals compared to 2023—315 deals raising $6.5B in 2024 compared to 325 deals raising $5.8B in 2023.

Series C and later rounds saw the slowest growth. They also experienced considerable pressure on valuations, with two thirds securing flat or down rounds.

These trends show that investors are seeking to lower financial risks and scrutinizing late-stage investments for stronger proof of viability, making it critical for companies to demonstrate clinical progress, regulatory traction, and a clear commercial strategy early in their development.

Investors reward innovation, but path to exit gets longer

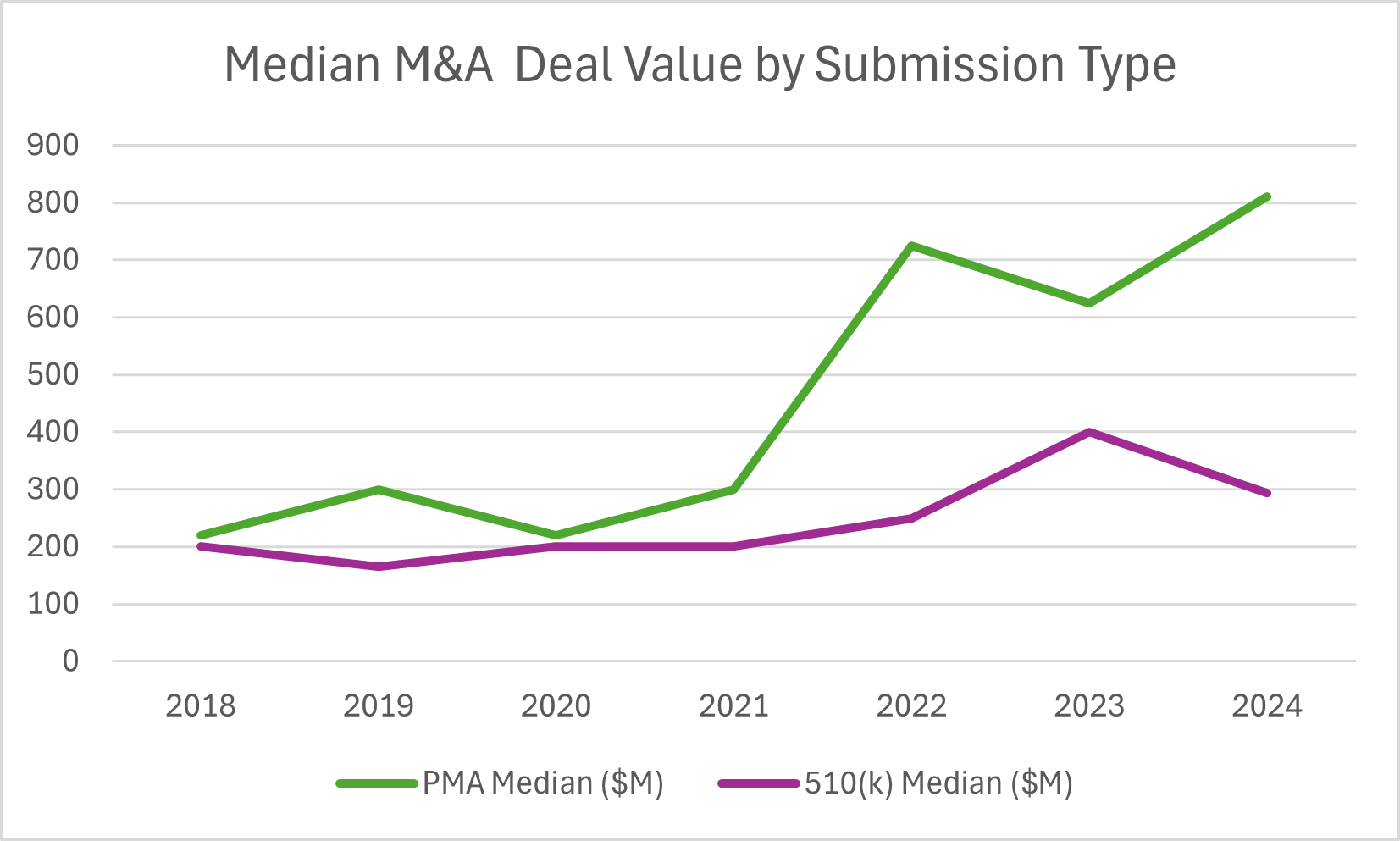

In 2024, M&A values for PMA (Pre-Market Approval) devices reached record highs, with median up-front payments hitting $550M and total deal values reaching $810M—both significantly higher than historical averages.

For 510(k) devices, 2024 showed a return to higher deal volume with 10 transactions (up from just 3 in 2023), but with more moderate valuations—median up-front payments of $254M and total deal values of $293M, down from the 2023 peaks or both metrics.

2024 saw longer exit timelines for both pathways. PMA deals averaged 13.8 years, while 510(k) deals reached 11.1 years, suggesting companies needed more time to achieve exit-worthy milestones compared to previous years. Notably, all 510(k) acquisitions over the past three years were for FDA-cleared, revenue-generating products, emphasizing the importance of commercial readiness.

Source: HSBC 2024 Annual Venture Healthcare Report

Neurology leads the pack for new investments

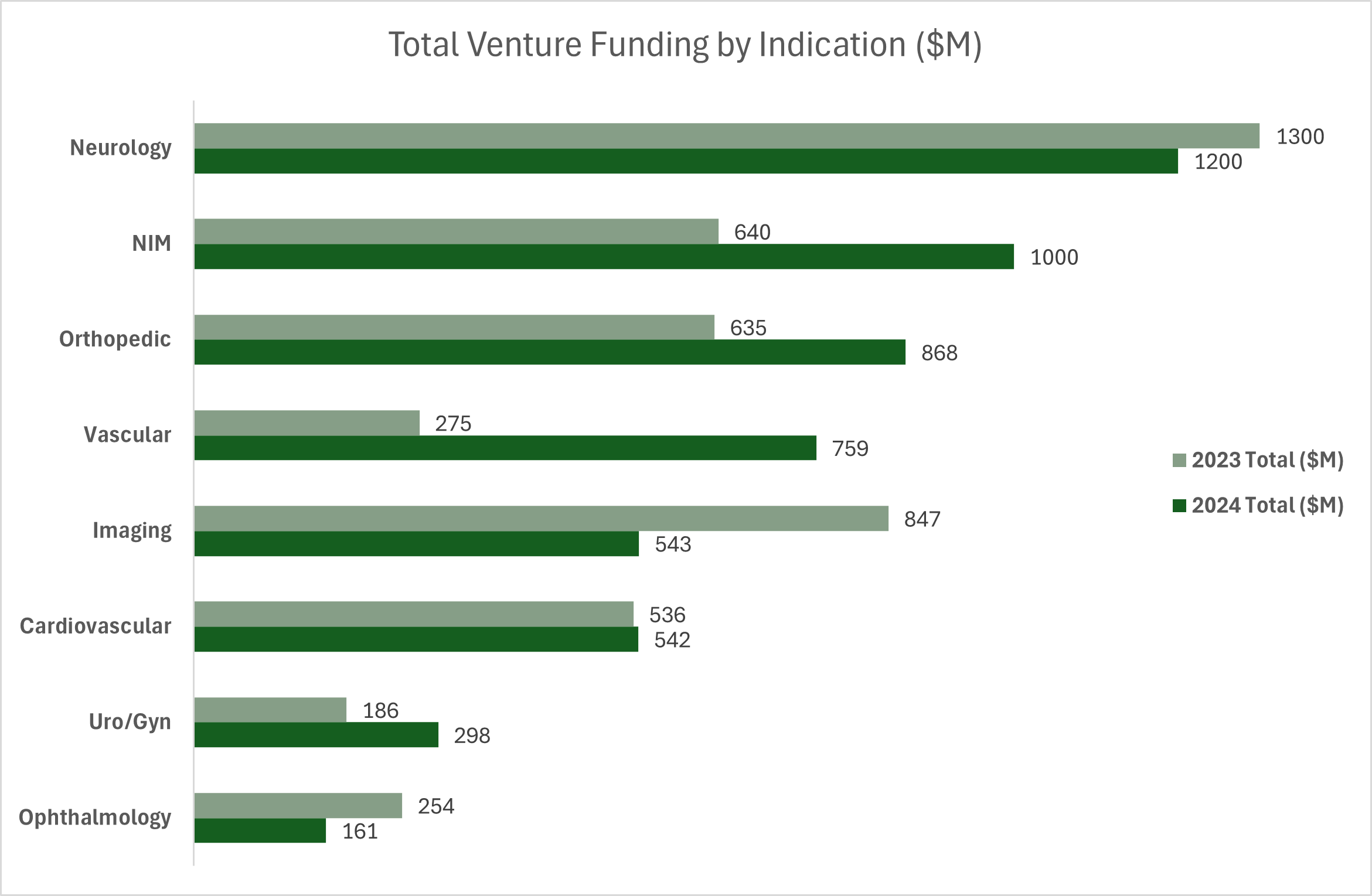

Neurology remained the leading area for medical device investment in 2024, attracting $1.2 billion across 48 deals, slightly down from $1.3 billion in 2023. Funding was driven by strong interest in brain-computer interface (BCI) and neurostimulation technologies. Non-invasive monitoring (NIM) surpassed $1 billion in funding, a significant jump from $640 million in 2023, reflecting growing investor interest in cardiovascular and metabolic monitoring technologies.

Other high-growth areas included orthopedic and vascular devices. Orthopedic investment surged to $868 million across 54 deals, up from $635 million in 2023, with strong backing for implant technologies (19 deals) and surgical robotics (7 deals). Vascular investment more than doubled, reaching $759 million across 26 deals. Cardiovascular investment remained stable at $542 million, but funding was 15-20% lower than pre-2022 levels, reflecting a more selective investment approach.

In contrast, imaging investments declined sharply to $543 million (from $847 million in 2023), as the market became increasingly competitive with fewer acquirers.

Source: HSBC 2024 Annual Venture Healthcare Report

What this means for medical device startups

Opportunities at the bookends

The surge in M&A activity presents strong exit opportunities for later-stage startups, particularly those with regulatory approvals and market-ready products. Investors are showing enthusiasm for robotics, AI-driven diagnostics, and cardiac monitoring devices, making these key areas of innovation and growth. Early-stage funding is strong, meaning that new ideas get more opportunities to prove their worth.

Challenges on the long road

The slow growth and high number of flat or down rounds in late-stage funding means that securing subsequent investment beyond the early stages is more difficult than in previous years. Investors are demanding clear milestones, such as clinical validation, regulatory approvals, and reimbursement strategies, before committing capital.

To put it in plain words, investors are saying “we’ll give you the money to develop your idea, but you better show us you can make it before we give you more money.”

Strategies for success

For startups that can prove their worth and push past these challenges, the long-term outlook remains promising, with M&A exits offering a viable path forward.

The takeaways for startups are:

1. Define and prioritize milestones

Prioritizing critical milestones can help startups manage their cash flow and maintain investor confidence. Clearly define achievable goals for each stage of development, from proof of concept (POC) to clinical trials and eventual market entry. Fixed-cost pricing for predefined milestones helps eliminate unexpected expenses, giving startups better control over their cash outlay and reducing financial risk.

“Working with Nocturnal has dramatically accelerated our time-to-market. In just one year, Nocturnal took our implantable cardiac monitor from a concept to a fully functional device with a mobile application and secure cloud connectivity.”

- Jaeson Bang, Founder and CEO, Future Cardia

2. Implement a strong Quality Management System (QMS) early on

Prioritizing quality from the outset minimizes regulatory risks, protects brand reputation, and accelerates market adoption. A well-documented Quality Management System (QMS) is essential for regulatory approval and long-term success. Regulatory bodies like the FDA require a structured QMS to ensure product safety and effectiveness throughout its lifecycle. Beyond compliance, a strong QMS enhances operational efficiency, ensuring consistency, reducing errors, and freeing up resources for innovation.

3. Establish predictable costs for predefined milestones

With guaranteed product development costs for predefined deliverables, startups gain cash flow predictability while reducing financial strain and optimizing resource allocation. Adopting a milestone-based pricing model fosters transparency and trust between startups and development partners, ensuring that both parties are aligned in their goals and keeping projects on track and within budget.

“This was my first experience with milestone-based pricing, and I will never go back to hourly billing. Nocturnal’s process ensures all parties are fully aligned and incentivized for success, and the results speak for themselves."

- Medical Device Stealth Startup CEO

Additional resources

- The Startup Guidebook: Navigating Medical Device Funding Cycles

- How we make fixed-cost pricing work

- Contact us to see how milestone-based pricing can work for your project.

MOST READ POSTS

Insights from a decade of milestone-based projects

Transforming biosignals into clinical insights

Why investors say No to medical device startups