The cold reality: Investment money is getting even harder to come by these days.

When this article was initially published in 2023, things did not look great for medical device startups. Fast forward to 2025, and the picture looks eerily familiar.

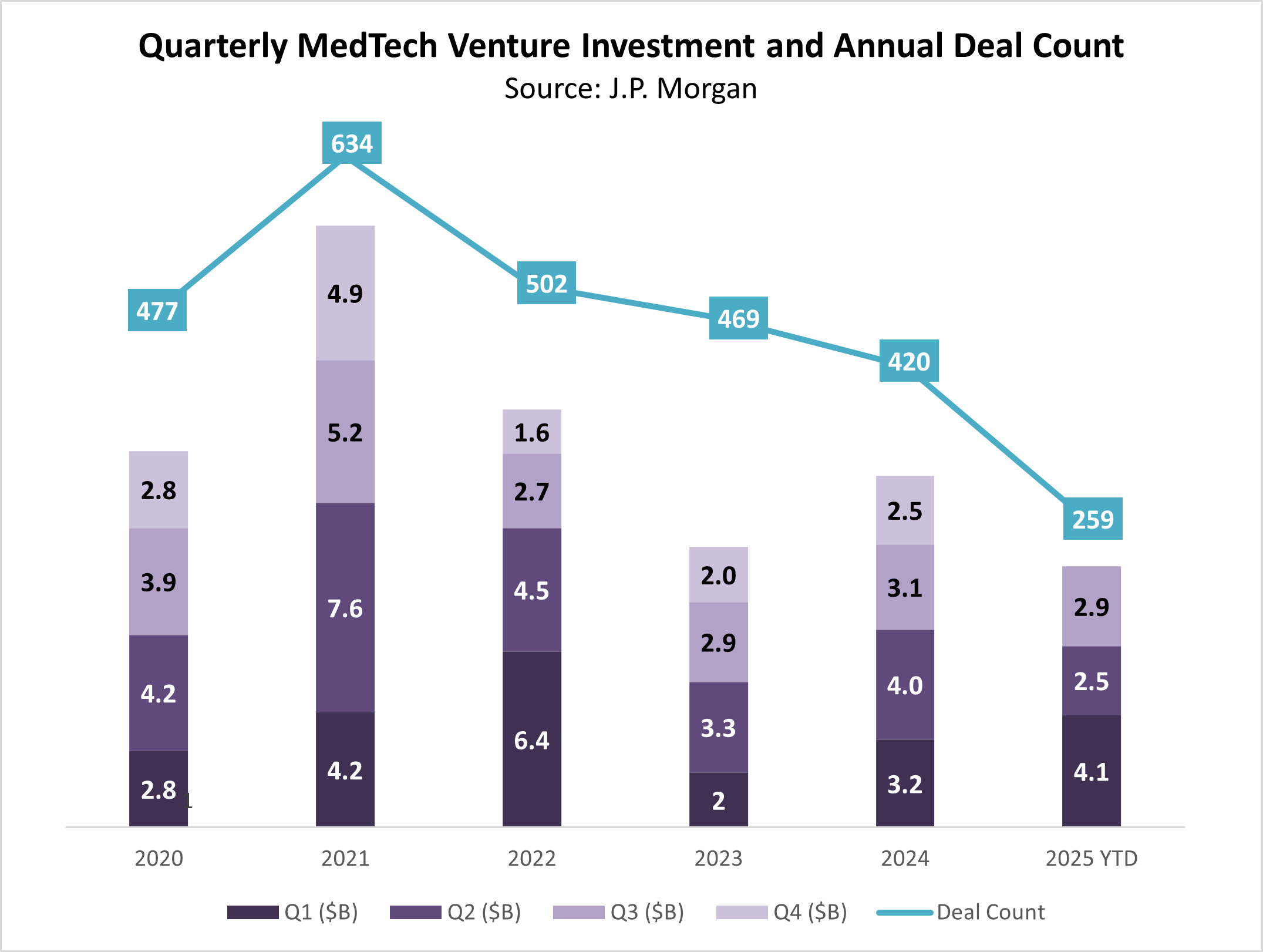

After a promising rebound in 2024, the Q3 2025 J.P. Morgan MedTech report reveals a challenging funding environment for early-stage companies.

While the total investment through Q3 seems to be on pace with the past two years, the total number of venture rounds YTD (259) is on pace for the lowest number on record in the last six years.

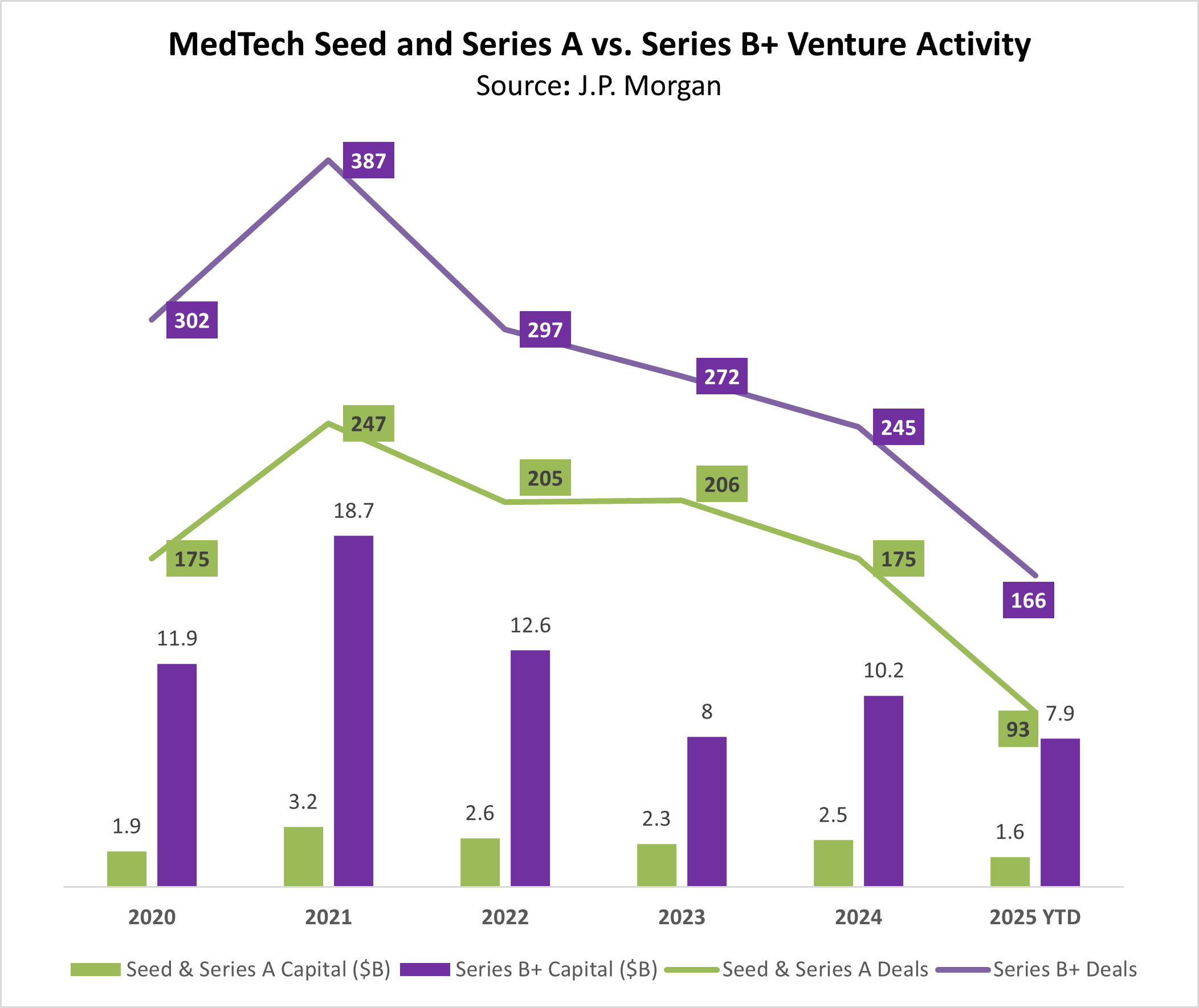

The downturn is substantially more pronounced for early stage deals — only 93 seed and A rounds were completed so far this year, by far the lowest on record in recent history.

For medical device companies, this means a shorter runway to meet product milestones. It also means they have less room for errors and missteps, which could lead investors to pull out or force a significant down-round.

First thing first: Understanding investor risk factors

Investors these days are more cautious, and to be honest, they have good reasons to be.

While economic uncertainty and rising interest rates play a role in the decline of investment across all sectors, medical device companies face some unique challenges that give many investors a longer pause when it comes to committing their capital.

- Product development challenges: The lengthy product development cycles associated with medical device commercialization, combined with supply chain delays, create significant uncertainty about product cost and time-to-revenue. Prolonged product development cycles also bring greater risk of changing market conditions, which could adversely impact product viability, competitiveness, pricing, and profitability.

- Regulatory challenges: Investors look for companies that have a well-defined reimbursement strategy and a solid plan for clearing regulatory hurdles – from obtaining the necessary documentation to conducting testing and completing clinical trials.

- Manufacturing challenges: Scaling up production and manufacturing of medical devices can be complex and costly. Investors may be wary of startups that lack a clear plan and the right partners lined up to support scalable manufacturing.

While none of these factors can be completely removed, there are several ways in which medical device entrepreneurs can mitigate these risks to ease investor apprehension.

And here is the good news: Proactively addressing these concerns can also help startups stretch their raised capital to meet development milestones and reduce the risk of running out of runway.

Read more: Why investors say No

Manage to your goal: What you really need for a POC vs. v1 and v2

Running out of funds before reaching a market-ready product is a common pitfall for medical device companies. With that in mind, it's crucial to prioritize and focus on the essentials of what the company needs to prove at each stage in order to raise additional capital.

To understand the difference in the development effort for a POC and a Version One of the product, it’s important to understand the different purposes they serve.

The purpose of a POC is to demonstrate the feasibility of the concept to the investors, which typically doesn’t require the full functionality of the product. A POC version doesn’t need to be approved by a regulatory body, which means that there are no certification and documentation requirements imposed by regulators. The POC may also be designed and built using components that aren’t necessarily suitable for long-term use in a medical device, but are expedient for demonstration.

Version One, by contrast, must be fully functional and ready for use in clinical trials. It must be suitable for submission for regulatory approval, which implies strict compliance and documentation requirements.

This doesn’t mean, though, that Version One needs to have all the bells and whistles. The more efficient product development strategy is to treat v1 as a Minimum Viable Product (MVP) that can be used for clinical trials.

While v1 may not be ready to be commercially marketed, its primary goal is to provide entrepreneurs with sufficient clinical data to validate the efficacy and safety of their medical device. These results can be leveraged to raise funds for further development to bring the desired product to market.

Ideally, entrepreneurs should develop their v2 in parallel, to capitalize on the momentum gained from the v1 trials. This allows for a more efficient timeline, as v2 can be commercialized relatively quickly based on its similarity to v1 and the ability to leverage clinical data obtained with v1.

When developing v2, entrepreneurs should focus on addressing the shortcomings or less desirable aspects of v1 that were not necessary for proving the technology's effectiveness in the clinical trials. This could involve improvements such as reducing form factor, increasing battery life, or enhancing usability.

By refining the product based on user feedback and market demands, v2 and subsequent versions can become more attractive to potential customers and investors.

Cash is king: Accurately predicting development costs and timeline

Entrepreneurs are an optimistic bunch. But that can sometimes come back and bite them.

If they haven’t gone through the process before, entrepreneurs may also not have full appreciation of what goes into the product development process beyond the core technology. They are often unaware of what it takes to produce the proper documentation that is necessary to meet regulatory requirements. And they tend to grossly underestimate the time and effort required for verification and validation.

To create a realistic product development plan with a predictable cost and timeline, you need someone on your team that has been through the entire process and appreciates all of the steps and details involved.

Another way to ensure predictable development costs and timeline is by contracting a design partner to deliver the desired product milestones at a fixed cost and time. The reality is that most design and development contractors will not commit to fixed costs and times, since they are unwilling to assume the risk of overrunning the time and effort they estimated for the project.

Only design firms with extensive experience in developing similar devices may be willing to commit to a fixed cost project and share the risk with you.

Stay on track: Controlling scope creep

Scope creep can be highly detrimental to cash-strapped startups.

To start with, it's important to have a clear understanding of your product's scope from the beginning and document it in a detailed project plan.

When new ideas or feature requests arise, carefully consider what goals they support and where you are in the product development cycle. In most cases, you’d be better off putting these requests on the list of considerations for a future version rather than disrupting the timeline for the current version.

Working with a partner on a fixed price for predetermined milestones can be helpful for controlling scope drift. It makes the entrepreneur clearly aware of the time and cost that out-of-scope feature requirements would add to the project. When these tradeoffs are clear, it is easier to make the right decision.

Read more: How we manage fixed-cost projects

Plan for scale: Partnering with the right manufacturers

When it comes to complex and novel medical device innovations, finding the right manufacturing partner is far from trivial.

To start with, you’d be looking for manufacturers with experience with similar devices and a track record of delivering high-quality products within budget and timeline constraints.

When bringing a new device to market, you need a partner who can accommodate your initial trial quantities, while offering the potential to scale up production as your business grows. This scalability is essential to avoid disruptions and higher costs associated with transitioning to a new manufacturing facility later on.

Last but not least: Keeping the team together

Cutting costs and downsizing the team can be demoralizing and may lead to a loss of valuable talent. To mitigate these risks, be conservative with your hiring decisions, only bringing on board essential personnel that you know you’ll need for the long-run. Consider leveraging outsourcing strategically to provide flexibility and access to specialized skills while maintaining a predictable cash burn rate. Once your product has cleared regulatory hurdles and is ready for production at scale, you’ll be better prepared to hire additional resources and bring these skills inhouse.

Final words and takeaways

While launching a medical device startup with limited funds presents many challenges, it's not an insurmountable task. By carefully considering design priorities to control costs and scope, you can navigate the cash-strapped startup journey more effectively.

- Understand the differences in goals and requirements for a Proof of Concept (POC), v1, and v2 product design.

- Consider a fixed cost development partner to help you accurately predict and manage product development costs and timeline.

- Choose manufacturing partners with the ability to support small V&V and trial quantities and scale up production as the business grows.

- Be conservative with hiring decisions, consider strategic outsourcing for specialized skills, and plan to expand the team once the product is ready for production at scale.

Read more: Insights from a decade of milestone-based pricing projects

Get the ultimate guide to navigating funding cycles

MOST READ POSTS

Insights from a decade of milestone-based projects

Transforming biosignals into clinical insights

Why investors say No to medical device startups